PLANO, Texas, April 8, 2024 (SEND2PRESS NEWSWIRE) — Today, Optimal Blue released its March 2024 Originations Market Monitor report, which reveals the average homebuyer credit score has reached 737 – an all-time high since the company began tracking this data in January 2018. Despite the potential buyer pool being somewhat limited to borrowers with higher credit, rate lock volume showed steady month-over-month growth of 17% in March as the spring buying season got underway.

Image caption: Optimal Blue Issues March 2024 Originations Market Monitor.

Key findings from the March 2024 Originations Market Monitor report, which reflects month-over-month changes in mortgage lock data, include:

- Unprecedented credit scores: March recorded the highest average borrower credit score for purchase loans at 737 since tracking commenced in January 2018. Similarly, in February and March 2024, FHA borrower credit scores reached six-year highs of 677 and 676, respectively. VA borrower credit scores reached their peak since February 2021, and conforming loan borrower credit scores achieved their highest mark since January 2021.

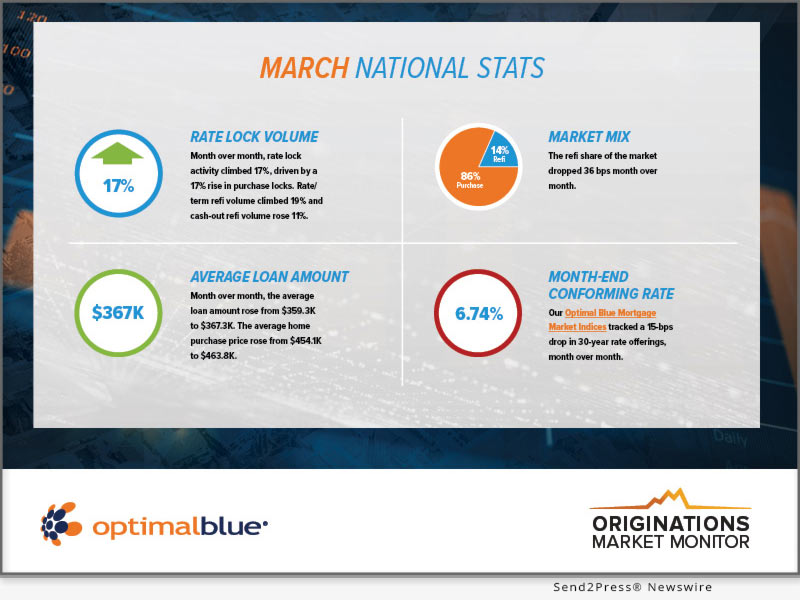

- Spring rate lock activity surge: March saw a notable 17% increase in rate lock volume, driven by a 17% rise in purchase locks. While refinances comprised a small share of lock volume, rate/term activity rose 19% and cash-out activity rose 11%, aided by an improving rate environment.

- Interest rates tick down: The Optimal Blue Mortgage Market Indices (OBMMI) 30-year benchmark rate decreased by 15 bps to 6.74%, signaling an improving rate environment conducive to both purchase and refinance transactions. The OBMMI jumbo index saw the largest rally, dropping 27 bps to 7.07%.

- Year-over-year comparison: Despite strong month-over-month gains, March purchase lock counts were down 24% from the same period in 2023. This year-over-year decline is likely due to the Easter holiday weekend falling in March this year and April last year. April and May figures will be a better indicator of whether the market is turning a corner.

- Market share adjustments: FHA lending saw its fourth straight month-over-month decline in market share, falling 0.72% to capture a 19% share of total lock volume. FHA volume had seen relatively consistent growth from 2021–2023, with market share growing from 9% to a peak of 23% in November 2023 before the recent stretch of declines.

- Loan amounts and prices increase: The average loan amount rose by $8,000 to $367.3K, and the average home purchase price increased $9,700 to $463.8K.

“Driven by rising interest rates and home prices, we’re witnessing the highest average homebuyer credit scores in years,” said Brennan O’Connell, director of data solutions at Optimal Blue. “This unprecedented level of creditworthiness among purchasers is largely a result of the affordability issues borrowers face in today’s housing market, with prospective buyers with lower credit scores waiting on the sidelines until conditions improve. However, it is encouraging to see a strong pool of qualified buyers still actively pursuing homeownership. This trend underscores the resilience of the market and the adaptability of consumers in navigating the current economic landscape.”

The full March 2024 Originations Market Monitor report provides further detail on these findings and more insights into U.S. mortgage market trends: https://www2.optimalblue.com/wp-content/uploads/2024/04/OB_OMM_MAR2024_Report.pdf

About the OMM Report:

Each month, Optimal Blue issues the Originations Market Monitor report, which provides early insight into U.S. mortgage trends. Leveraging lender rate lock data from the Optimal Blue PPE — the mortgage industry’s most widely used product, pricing, and eligibility engine — the Originations Market Monitor provides a view of early-stage origination activity.

Nothing herein shall be construed as, nor is Optimal Blue providing, any legal, trading, hedging, or financial advice.

About Optimal Blue:

Optimal Blue is a market leader in mortgage secondary marketing technology. The company facilitates transactions among mortgage market participants through its Marketplace Platform, actionable data, and technology vendor connections. The platform supports a range of functions for originators and investors to automate and optimize core processes related to product, pricing, and eligibility, hedge analytics, MSR valuation, loan trading, social media compliance, and counterparty oversight. The company’s premier products are used by 68% of the top 500 mortgage lenders in the U.S.

For more information on Optimal Blue’s end-to-end secondary marketing automation, visit http://OptimalBlue.com/.

###

MEDIA ONLY CONTACT:

(not for print or online)

Johnna Szegda

Depth for Optimal Blue

johnna@depthpr.com

404.798.1155

News Source: Optimal Blue