MACON, Ga., July 27, 2021 (SEND2PRESS NEWSWIRE) — LBA Ware™, a leading provider of incentive compensation management (ICM) and business intelligence (BI) software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry loan compensation in the second quarter of 2021. The firm’s analysis of data from its CompenSafe™ ICM platform showed that despite a marginal increase in loan volume from Q2 2020 to Q2 2021, quarterly commissions per LO were down. Over the same period, loan processor workload and bonus compensation each decreased by about a quarter.

Methodology

LBA Ware reviewed account data for mortgage lenders who used CompenSafe to automate incentive compensation throughout the second quarters of both 2020 and 2021. The controlled sample dataset consisted of retail, first-lien production from LOs and loan processors with at least six funded loans during the three-month period beginning March 31, 2021, and ending June 30, 2021.

Key Findings

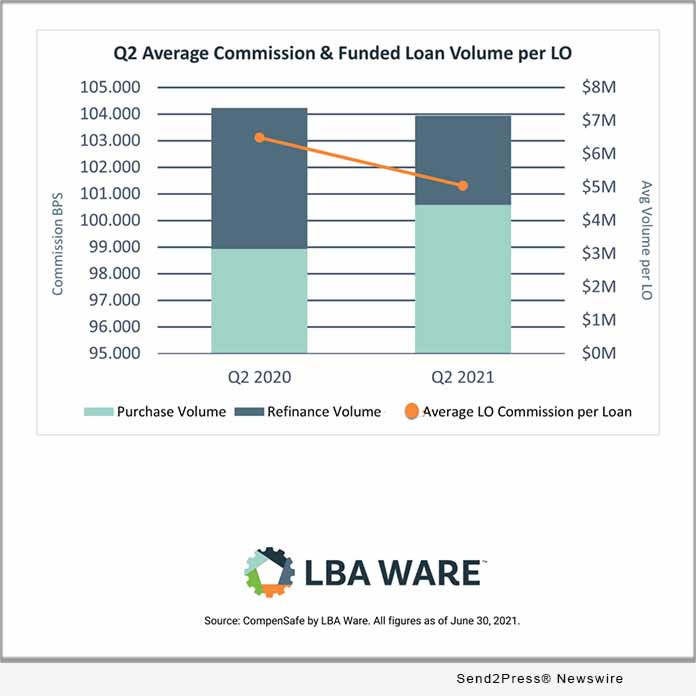

- Commissions earned per loan originator (LO) in Q2 2021 decreased 6% from Q2 2020. During the same period, loan volume per LO dropped 4% on average.

- LOs averaged $0.9M in funded refinance volume per month, a decrease of more than 36% over Q2 2020 ($1.4M), and received an average of 91.679 basis points (BPS) per refinance loan, a significant decrease of 6.94% from the average of 98.517 BPS in Q2 2020.

- Purchase volume grew 49% year-over-year, with individual LOs averaging $1.52M in funded purchase loans per month (a 41% increase over the $1.08M funded per LO in Q2 2020) and receiving on average 107.649 BPS per purchase loan (versus 108.836 in Q2 2020).

- Overall, LOs saw a 1.76% decrease in per-loan commissions from 103.119 BPS in Q2 2020 to 101.308 BPS in Q2 2021. LOs in the sample dataset took home an average of $2,876 in commissions per loan, or roughly 35% of the $8,243 it costs to originate a retail loan according to 2020 data from the Mortgage Bankers Association*.

- Loan processor staffing grew significantly (49%) from Q2 2020 to Q2 2021. Loan processors handled 27% fewer loans per month in Q2 2021 (15.7 units) compared to Q2 2020 (21.7 units), fueling a corresponding 26% decrease in quarterly bonus compensation earned from $2,684 per processor per month in Q2 2020 to $1,999 in Q2 2021.

“LOs continue to benefit from a strong purchase market buoyed by low rates, flex work opportunities and millennials moving out of their parents’ homes. If the macroeconomic environment stays strong for the second half of 2021, LOs could have another banner year,” said LBA Ware Founder and CEO Lori Brewer. “Another notable observation is that lenders added processing manpower at almost ten times the rate they added LOs in Q2. It remains to be seen if that level of operational staffing will be sustainable over the long term.”

*Source: Mortgage Bankers Association’s Chart of the Week for July 23, 2021: https://www.mba.org/news-research-and-resources/research-and-economics

About LBA Ware™:

LBA Ware is a leading provider of cloud-based software for mortgage lenders. Since 2008, LBA Ware has been on a mission to help mortgage companies reach new heights with software that integrates data, incentivizes performance and inspires results. Today, more than 100 lenders of all sizes, including some of the nation’s top producing mortgage companies, use LBA Ware’s award-winning technology to enhance lender experiences and maximize the human potential within their organizations. A 2020 Inc. 5000 fastest-growing private company, LBA Ware is headquartered in Macon, Georgia. For more information, visit https://www.lbaware.com/.

Twitter: @LBAWare #mortgageindustry #mortgagetechnology #mortgagelending

News Source: LBA Ware