LEHI, Utah, Nov. 2, 2021 (SEND2PRESS NEWSWIRE) — SimpleNexus, owner of the recently acquired LBA Ware™, a leading provider of incentive compensation management (ICM) and business intelligence (BI) software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry loan compensation in the third quarter of 2021. Analysis of data from the CompenSafe™ ICM platform showed that declining loan volume in Q3 2021 compared to Q3 2020 pushed quarterly loan originator (LO) commission earnings down 17%. Over the same period, mortgage lenders increased loan processor staffing by roughly a quarter while funding fewer loans, driving average individual processor incentive compensation down by a third.

Methodology

SimpleNexus’ LBA Ware team reviewed account data for mortgage lenders who used CompenSafe to automate incentive compensation throughout the third quarters of both 2020 and 2021. The controlled sample dataset consisted of retail, first-lien production from LOs and loan processors with at least six funded loans during the three-month period beginning July 1, 2021, and ending September 30, 2021.

Key Findings

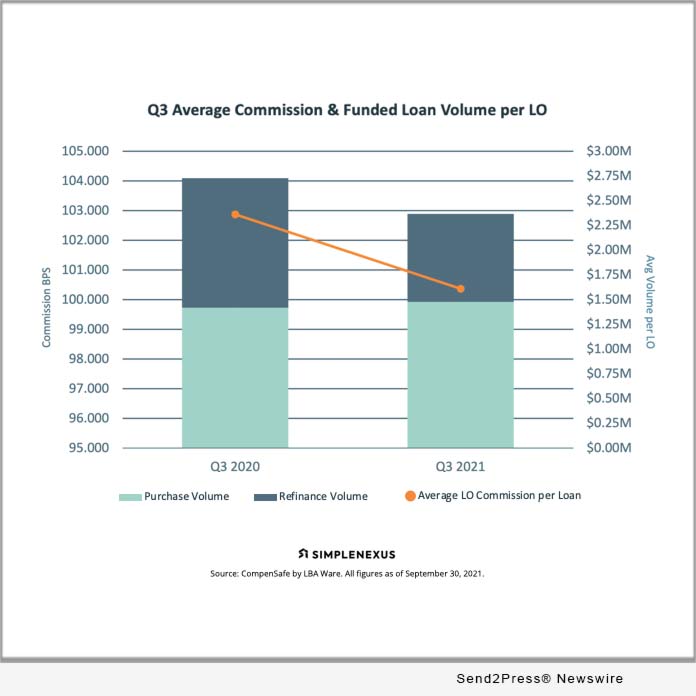

- Monthly commissions earned per LO in Q3 2021 decreased 17% overall from Q3 2020. Monthly refinance commissions decreased 37%, accounting for most of the shortfall, while monthly purchase loan commissions held relatively steady, rising just 2%.

- Overall, LOs saw a 2.44% decrease in per-loan commission rates from 102.878 basis points (BPS) in Q3 2020 to 100.372 BPS in Q3 2021. Notably, lenders dialed down per-loan commission rates on refinances by 7.17%, from 95.210 BPS in Q3 2020 to 88.384 BPS in Q3 2021. BPS paid out on purchase loans decreased 1.58% from 109.838 to 108.102.

- LOs averaged $2.2M in funded volume per month in Q3 2021, a decrease of 14.9% from Q3 2020 ($2.6M). Purchase volume funded by individual LOs increased 4% from $1.4M in Q3 2020 to $1.5M Q3 2021, and refinance volume declined 32% from $1.3M to $0.9M during the same period.

- LO staffing levels held relatively steady from Q3 2020 to Q3 2021, dipping just 2%. Simultaneously, loans funded per LO per month decreased 22%, with LOs in the sample set averaging 9.0 loans a month in Q3 2020 versus 7.0 loans a month in Q3 2021.

- Loan processor staffing grew 23% from Q3 2020 to Q3 2021. Loan processors averaged 29% fewer loans per month in Q3 2021 (15.2 units) compared to Q3 2020 (21.5 units), fueling a 33% decrease in quarterly bonus compensation earned from $3,201 per processor per month in Q3 2020 to $2,140 in Q3 2021.

“The heyday of ultra-low rates and enormous refinance volume is over, and compensation is starting to settle back to pre-pandemic levels. On the bright side, 2021 is still shaping up to be the second-highest production year in the last decade, with modest growth in the purchase market helping take the edge off declining refinance volumes,” said SimpleNexus EVP and General Manager Lori Brewer. “We will be watching to see if lenders reduce headcount or take a more conservative approach to incentive comp to protect margin.”

About SimpleNexus, LLC:

Founded in 2011, SimpleNexus is an award-winning developer of mobile-first technology for the modern mortgage lender. Lenders depend on our namesake homeownership platform to unite the people, systems and stages of the mortgage process into a seamless, end-to-end solution that spans engagement, origination, closing and business intelligence. By helping lenders manage their teams and stay connected with borrowers and real estate partners, we deliver a measurable return on investment in the form of reduced turn times, increased loan application submissions and more referral business. A four-time Inc. 5000 company, SimpleNexus has been recognized as one of the world’s Best Workplaces for Innovators. For more information, visit https://www.simplenexus.com/ or follow @SimpleNexus.

Twitter: @SimpleNexus @LBAWare #mortgageindustry #mortgagetechnology #mortgagelending

News Source: SimpleNexus